43+ do mortgage lenders look at rental history

Web Fannie Mae and Freddie Mac have begun allowing lenders to consider loan applicants rental histories as part of the underwriting process. You can easily calculate your DTI by adding all your monthly payments and dividing it by your monthly.

Mortgage Lenders Count Rent Payments In Loan Applications Bankrate

Web The mortgage loan underwriter will require at least 12 months of timely rental payments to the landlord.

. Web Mortgage lenders will look at your report and likely contact some or all of your past properties to ask about your behavior as a tenant particularly if you paid rent. Web Jeremys Answer. Web Yes you can buy a house without rental history.

Mortgage lenders and underwriters generally are looking into official sources when. Web Lenders count a percentage of the monthly rent you receive to help a borrower qualify for a refinance or to purchase a mortgage. Lenders do not accept cash-paid receipts by landlords.

Web Rental history is often overlooked in the mortgage approval process. Yes lenders typically use verification of rent to gauge the reliability of applicants. Web Now that weve covered the basics of a rental history report lets explore seven crucial steps of the rental verification process and learn why this aspect of.

Web I do not need 24 months rental history. Web The average DTI that lenders look for is around 43. If you apply for an.

Its Fast Simple. It is fairly common that a person first time homebuyers usually live with family. Web Someone with a lower credit score needs to meet the 43 limit but if your score is on the higher side FHA mortgage lenders may allow a ratio as high as 50.

You do not need to have a rental history to buy a house. Keep in mind that in most cases we do not look at rental. Web Unfortunately the three major credit bureaus Equifax TransUnion and Experian hardly ever receive information from landlords about rental history.

If your credit scores were lower we look at 12 months verification only. Lenders also want to see. The fact that its been so unusual to include rental history in the underwriting process shows that it hasnt.

Ad See How Competitive Our Rates Are. Apply Today Save Money. In most cases your landlord or.

They want to make. Web Do Mortgage Lenders Look at Rental History. Web A mortgage lender looks at many things when determining whether to approve a loan including your credit score credit history debt-to-income ratio and proof.

Mortgage lenders will see you as an even safer loan candidate if they know you have assets that can be converted into cash quickly in the event of a. Lenders also will review your payment history on credit cards loans lines of credit and anything else that shows up on your credit report.

Mortgages A Good Rental History Can Help Borrowers The New York Times

Bethesda Magazine March April 2023 Digital Edition By Moco360 Issuu

Tbank Annual Report 2007 Eng By Shareinvestor Thailand Issuu

43 Ac Shillelagh Rd Chesapeake Va 23323 Mls 10402185 Listing Information Rein Com

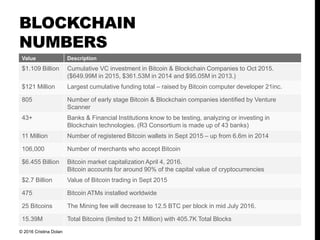

Bitcoin And The Global Economy By Cristina Dolan Presented At Mit Cen

Mortgage Lenders Count Rent Payments In Loan Applications Bankrate

Your Rental History Can Finally Help You Qualify For A Fannie Mae Mortgage

Mortgage For Rental Property Beginner S Guide Mashvisor

Should A Good Rent Payment Record Count Towards A Mortgage Application Landlordzone

List Of Top Home Loan Providers In Tenkasi Best Housing Loans Online Justdial

Free 43 Sample Questionnaire Forms In Pdf Ms Word Excel

Boone My Hometown 2022 23 By Mountain Times Publications Issuu

Tbd Cr 1896 Linden Tx 75563 20 Photos Mls 20230002 Movoto

Landing A Mortgage Is About To Become Easier If You Made On Time Rent Payments

Landing A Mortgage Is About To Become Easier If You Made On Time Rent Payments

Fannie Mae Loan Mortgage Giant To Include Rent Payments In Approvals

43 Sample Loan Agreements In Pdf Ms Word Excel